Transaction Types

Sale

Sale

A sale initiates a payment operation to the card reader. In it's simplest form you only have to pass the amount and currency but it also accepts tip configuration and a map with extra parameters.

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to charge - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

options SaleOptions | An object to store all the customization options for a sale (Tip Configuration, Metadata, Money Remittance Options,...) |

Code example

//Initiate a sale for 10.00 in Great British Pounds

api.sale(new BigInteger("1000"),Currency.GBP);

//Initiate a sale for 10.00 in Great British Pounds with a tipping configuration

//This feature is only available for PAX and Telpo devices

TipConfiguration tipConfiguration = new TipConfiguration();

tipConfiguration.setTipPercentages(Arrays.asList(5, 10, 15, 20));

tipConfiguration.setTipAmount(new BigInteger("1000"));

tipConfiguration.setBaseAmount(new BigInteger("1000"));

tipConfiguration.setEnterAmountEnabled(true);

tipConfiguration.setFooter("Thank you");

tipConfiguration.setSkipEnabled(true);

// Metadata

Metadata metadata = new Metadata("Data 1", "Data 2", "Data 3", "Data 4", "Data 5");

SaleOptions options = new SaleOptions();

options.setTipConfiguration(tipConfiguration);

options.setMetadata(metadata);

api.sale(new BigInteger("1000"),Currency.GBP, options);

//Initiate a sale for 10.00 USD using Money Remitance options

MoneyRemittanceOptions moneyRemittanceOptions = new MoneyRemittanceOptions("John Doe", CountryCode.USA);

SaleOptions saleOptions = new SaleOptions(true, moneyRemittanceOptions);

api.sale(new BigInteger("1000"), Currency.USD, saleOptions);

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked if card verification requires signature.

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Sale And Tokenize Card

A sale operation which also returns a card token. (not available for all acquirers, please check with Handpoint to know if tokenization is supported for your acquirer of choice)

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to charge - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

options SaleAndTokenizeOptions | An object to store all the customization options for a sale (Tip Configuration, Money Remittance Options,...) |

Code example

//Initiate a sale for 10.00 in Great British Pounds

SaleOptions options = new SaleAndTokenizeOptions();

api.sale(new BigInteger("1000"),Currency.GBP, options);

//Initiate a sale for 10.00 in Great British Pounds with a tipping configuration

//This feature is only available for PAX and Telpo devices

TipConfiguration tipConfiguration = new TipConfiguration();

tipConfiguration.setTipPercentages(Arrays.asList(5, 10, 15, 20));

tipConfiguration.setTipAmount(new BigInteger("1000"));

tipConfiguration.setBaseAmount(new BigInteger("1000"));

tipConfiguration.setEnterAmountEnabled(true);

tipConfiguration.setFooter("Thank you");

tipConfiguration.setSkipEnabled(true);

SaleOptions options = new SaleOptions();

options.setTipConfiguration(tipConfiguration);

options.toSaleAndTokenizeOptions();

api.sale(new BigInteger("1000"),Currency.GBP,options);

//Initiate a sale for 10.00 USD using Money Remitance options

MoneyRemittanceOptions moneyRemittanceOptions = new MoneyRemittanceOptions("John Doe", CountryCode.USA);

SaleAndTokenizeOptions saleAndTokenizeOptions= new SaleAndTokenizeOptions(moneyRemittanceOptions);

api.sale(new BigInteger("1000"), Currency.USD, saleAndTokenizeOptions);

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked if card verification requires signature.

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Sale Reversal

saleReversal

A sale reversal, also called sale VOID allows the user to reverse a previous sale operation. This operation reverts (if possible) a specific sale identified with a transaction id. In its simplest form you only have to pass the amount, currency and originalTransactionID but it also accepts a map with extra parameters. Note that transactions can only be reversed within a 24 hours timeframe or until the daily batch of transactions has been sent for submission.

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to charge - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

originalTransactionID Required String | Id of the original sale transaction |

options SaleOptions | An object to store all the customization options for a sale. |

Code example

//Initiate a reversal for 10.00 in Great British Pounds

api.saleReversal(new BigInteger("1000"),Currency.GBP,"00000000-0000-0000-0000-000000000000");

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked if card verification requires signature.

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Refund

refund

A refund operation moves funds from the merchant account to the cardholder´s credit card. In it's simplest form you only have to pass the amount and currency but it also accepts a map with extra parameters. Note that a card is required to be swiped, dipped or tapped for this operation. For Interac (Canadian Debit Network), refunds can only be processed until Interac closes the batch of transactions at night.

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to charge - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

originalTransactionID String | If present it links the refund with a previous sale. It effectively limits the maximum amount refunded to that of the original transaction. |

options RefundOptions | An object to store all the customization options for a refund (Metadata, Money Remittance Options,...) |

Code example

//Initiate a refund for 10.00 in Great British Pounds (Linked Refund)

api.refund(new BigInteger("1000"),Currency.GBP,"00000000-0000-0000-0000-000000000000");

//Initiate a refund for 10.00 USD using Money Remitance options (Linked Refund)

MoneyRemittanceOptions moneyRemittanceOptions = new MoneyRemittanceOptions("John Doe", CountryCode.USA);

RefundOptions refundOptions= new RefundOptions(true, moneyRemittanceOptions);

api.refund(new BigInteger("1000"), Currency.GBP, "00000000-0000-0000-0000-000000000000", refundOptions);

** Events invoked**

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry')

Invoked if card verification requires signature.

Invoked when the terminal finishes processing the transaction

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Automatic Refund

automaticRefund

A refund operation moves funds from the merchant account to the cardholder's credit card. This operation allows you to refund to a card automatically without requiring the cardholder to dip/tap/swipe his card. In its simplest form you only have to pass the Original Transaction ID (GUID) to this function. The amount to be refunded will be topped to a maximum of the amount of the original sale.

Parameters

| Parameter | Notes |

|---|---|

originalTransactionID RequiredString | Links the automatic refund with a previous sale. The amount refunded will be the same as the one of the original transaction. |

options MoToOptions | An object to store optional parameters for a MoTo refund (MoTo Channel, Money Remittance Options,...) |

Code example

//Initiate an automatic refund

api.automaticRefund("00000000-0000-0000-0000-000000000000");

//Initiate an automatic refund using MoTo Options

MoToOptions moToOptions = new MoToOptions();

moToOptions.setChannel(MoToChannel.TO);

api.automaticRefund("00000000-0000-0000-0000-000000000000", moToOptions);

** Events invoked**

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry')

Invoked when the terminal finishes processing the transaction

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Automatic Partial Refund

automaticRefund

A refund operation moves funds from the merchant account to the cardholder's credit card. This operation allows you to PARTIALLY refund a card automatically without requiring the cardholder to dip/tap/swipe his card. In its simplest form you only have to pass the amount, currency and the Original Transaction ID (GUID). Note that the amount can not go above the amount of the original sale. If a refund is attempted for an amount higher than the one of the original sale, the transaction will be automatically declined.

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to refund - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the refund |

originalTransactionID Required String | Links the refund with a previous sale. It effectively limits the maximum amount refunded to that of the original transaction. |

options MoToOptions | An object to store optional parameters for a MoTo refund (MoTo Channel, Money Remittance Options,...) |

Code example

//Initiate an automatic partial refund for 5.00 Great British Pounds

api.automaticRefund(new BigInteger("500"),Currency.GBP,"00000000-0000-0000-0000-000000000000");

//Initiate an automatic partial refund for 5.00 Great British Pounds using MoTo Options

MoToOptions moToOptions = new MoToOptions();

moToOptions.setChannel(MoToChannel.MO);

api.automaticRefund(new BigInteger("500"),Currency.GBP,"00000000-0000-0000-0000-000000000000", moToOptions);

** Events invoked**

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry')

Invoked when the terminal finishes processing the transaction

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Refund reversal

refundReversal

A refund reversal, also called refund VOID allows the merchant to reverse a previous refund operation. This operation reverts (if possible) a specific refund identified with a transaction id. In it's simplest form you only have to pass the amount, currency and originalTransactionID but it also accepts a map with extra parameters. Note that transactions can only be reversed within a 24 hours timeframe or until the daily batch of transactions has been sent for submission.

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to charge - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

originalTransactionID Required String | transaction id of the original refund |

options SaleOptions | An object to store all the customization options for the transaction. |

Code example

//Initiate a refund reversal for 10.00 in Great British Pounds

api.refundReversal(new BigInteger("1000"),Currency.GBP,"00000000-0000-0000-0000-000000000000");

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked if card verification requires signature.

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

MoTo Sale

MoToSale

Mail Order /Telephone Order (MOTO) sale. MOTO is a type of card-not-present (CNP) transaction in which services are paid and delivered via telephone, mail, fax, or internet communication. MOTO has become synonymous with any financial transaction where the entity taking payment does not physically see the card used to make the purchase. This operation now supports the use of a cardToken via MoToOptions for secure, card-less transactions.

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to charge - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

options MoToOptions | An object to store optional parameters for a MoTo sale (MoTo Channel, Money Remittance Options,...) |

Code example

//Initiate a MoTo sale for 10.00 in Great British Pounds

MoToOptions options = new MoToOptions();

options.setCustomerReference("MoTo Sale Example");

api.motoSale(new BigInteger("1000"), Currency.EUR, options);

//Initiate a MoTo sale for 10.00 USD using Money Remitance options

MoneyRemittanceOptions moneyRemittanceOptions = new MoneyRemittanceOptions("Test Integration", CountryCode.USA);

MoToOptions moToOptions = new MoToOptions(moneyRemittanceOptions);

api.motoSale(new BigInteger("1000"), Currency.USD, moToOptions);

Code Example 2

// Initiate a MoTo sale using a cardToken

MoToOptions options = new MoToOptions();

options.setCardToken("your-stored-card-token");

options.setChannel(MoToChannel.TO);

api.motoSale(new BigInteger("1000"), Currency.EUR, options);

Events invoked

Invoked during a transaction, it fetches statuses coming from the sdk (ex : 'processing').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. |

MoTo Refund

moToRefund

A MOTO refund operation moves funds from the merchant account to the cardholder´s credit card. In it's simplest form you only have to pass the amount and currency but it also accepts the original transaction id. MOTO Refund is a type of card-not-present (CNP) transaction in which services are refunded via telephone, mail, fax, or internet communication. MOTO has become synonymous with any financial transaction where the entity taking payment does not physically see the card used to make the purchase or refund.

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to charge - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

originalTransactionId String | If present it links the refund with a previous sale. It effectively limits the maximum amount refunded to that of the original transaction. |

options MoToOptions | An object to store optional parameters for a MoTo refund (MoTo Channel, Money Remittance Options,...) |

Code example

MoToOptions options = new MoToOptions();

options.setCustomerReference("MoTo Refund Example");

api.motoRefund(new BigInteger("1000"), Currency.EUR, "00000000-0000-0000-0000-000000000000",options);

//Initiate a MoTo refund for 10.00 USD using Money Remitance options

MoneyRemittanceOptions moneyRemittanceOptions = new MoneyRemittanceOptions("John Doe", CountryCode.USA);

MoToOptions moToOptions = new MoToOptions(moneyRemittanceOptions);

api.motoRefund(new BigInteger("1000"), Currency.USD,"00000000-0000-0000-0000-000000000000", moToOptions);

Events invoked

Invoked during a transaction, it fetches statuses coming from the sdk (ex : 'processing').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. |

MoTo Reversal

moToReversal

A MOTO reversal, also called VOID allows the user to reverse a previous sale/refund operation. This operation reverts (if possible) a specific operation identified with a transaction id. Note that transactions can only be reversed within a 24 hours timeframe or until the daily batch of transactions has been sent for submission. MOTO Reversal is a type of card-not-present (CNP) transaction used to reverse a previous MOTO Sale or MOTO Refund.

Parameters

| Parameter | Notes |

|---|---|

originalTransactionId Required String | Id of the original sale transaction. |

amount String | (Optional) The amount to reverse from the original transaction. (Required for partial reversals). Check with Integration Support if your acquirer supports Partial Reversals |

currency String | (Optional) The currency of the original transaction. (Required for partial reversals) |

options MoToOptions | An object to store optional parameters for a MoTo reversal. |

Code example

MoToOptions options = new MoToOptions();

options.setCustomerReference("MoTo Reversal Example");

api.motoReversal("00000000-0000-0000-0000-000000000000",options);

// Simple MoTo reversal

api.motoReversal("00000000-0000-0000-0000-000000000000");

// MoTo reversal with explicit amount and currency

api.motoReversal("1000", "EUR", "00000000-0000-0000-0000-000000000000");

Events invoked

Invoked during a transaction, it fetches statuses coming from the sdk (ex : 'processing').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. |

MoTo Pre-Auth

motoPreauthorization

A MOTO pre-auth initiates a pre-authorization operation to the card reader. It's used to verify that the account is valid and has sufficient funds to cover a pending transaction, without actually debiting the cardholder's account upfront.

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to charge - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

options MoToOptions | An object to store optional parameters for a MoTo sale. |

Code example

MoToOptions options = new MoToOptions();

options.setCustomerReference("MoTo Sale Example");

api.motoPreauthorization(new BigInteger("1000"), Currency.EUR, options);

Events invoked

Invoked during a transaction, it fetches statuses coming from the sdk (ex : 'processing').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. |

Signature result

signatureResult

A signatureRequired event is invoked during a transaction when a signature verification is required (f.ex when a payment is done with a swiped or chip and sign card). The merchant is required to ask the cardholder for signature and approve (or decline) the signature. signatureResult tells the card reader if the signature was approved by passing the value true in the method. To decline a signature event then false should be passed to the card reader. Note that this event is only required for an HiLite or Hi5 integration and can be safely ignored for a PAX or Telpo integration.

Parameters

| Parameter | Notes |

|---|---|

accepted Required Boolean | pass true if merchant accepts cardholder signature |

Code example

//Approves signature automatically in signatureRequired event

@Override

public void signatureRequired(SignatureRequest signatureRequest, Device device){

api.signatureResult(true);

}

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Tip Adjustment

TipAdjustment

A tip adjustment operation allows merchants to adjust the tip amount of a sale transaction before the batch of transactions is settled by the processor at the end of the day. Note: This functionality is only available for the restaurant industry in the United States and the processors currently supporting this functionality are TSYS and VANTIV.

Dependencies: The code example provided depends on RxJava, take a look a their documentation to see how to easily include this dependency in your android project. If you do not want to use RxJava or any additional dependencies then AsyncTask, provided by android, can be used instead for this asynchronous processing. Still we recommend using RxJava as it improves readability and maintainability.

Parameters

| Parameter | Notes |

|---|---|

tipAmount Required BigDecimal | Tip amount added to the original (base) transaction amount - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required ENUM | Currency of the original transaction |

originalTransactionID Required String | Unique id of the original sale transaction as received from the card reader (EFTTransactionID) |

Code example

Observable.fromCallable(new Callable() {

@Override

public FinancialStatus call() throws Exception {

return api.tipAdjustment(new BigDecimal(1000), currency.GBP, "2bc23910-c3b3-11e6-9e62-07b2a5f091ec");

}

})

.subscribeOn(Schedulers.io())

.observeOn(AndroidSchedulers.mainThread())

.subscribe(new Consumer() {

@Override

public void accept(@NonNull FinancialStatus status) throws Exception {

if (status == FinancialStatus.AUTHORISED) {

//SUCCESS

} else if (status == FinancialStatus.DECLINED) {

//DECLINED

} else {

//FAILED

}

});

Returns

Result of the tip adjustment transaction, it returns a FinancialStatus, the possible values are :

| Parameter | Notes |

|---|---|

| FinancialStatus | - FinancialStatus.AUTHORISED (tip adjustment approved by the processor) - FinancialStatus.FAILED (system error or timeout) - FinancialStatus.DECLINED (tip adjustment declined by the processor). |

If two tip adjustments are sent for the same sale transaction, the second tip adjustment will override the first one. In case the transaction fails (not declined) we recommend that you prompt the user of the POS to retry the adjustment.

Tokenize Card

tokenizeCard

Returns a card token (not available for all acquirers, please check with Handpoint to know if tokenization is supported for your acquirer of choice)

Parameters

| Parameter | Notes |

|---|---|

options SaleOptions | An object to store all the customization options for the transaction. |

Code example

//Tokenize a card

api.tokenizeCard();

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Card PAN

cardPan

A cardPan request will return the full PAN of the card being swiped, dipped or tapped. Only the PANs of whitelisted card ranges will be returned by the Handpoint systems. This operation is mostly used to be able to process funds or points from loyalty cards.

Parameters

| Parameter | Notes |

|---|---|

options SaleOptions | An object to store all the customization options for the transaction. |

Code example

//Gets the PAN of a card

api.cardPan();

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation started. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Pre-Auth

preAuthorization

A pre-auth initiates a pre-authorization operation to the card reader. In it's simplest form you only have to pass the amount and currency but it also accepts tip configuration and a map with extra parameters. A pre-authorization charge, also known as a pre-auth or authorization hold, is a temporary hold placed on a customer's payment card. It's used to verify that the account is valid and has sufficient funds to cover a pending transaction, without actually debiting the cardholder's account upfront.

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to pre-auth - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

preauthOptions MerchantAuthOptions | An object to store merchant authentication options for pre-auth operations. |

Code example

//Initiate a pre-auth for 1.00 in Great British Pounds

api.preAuthorization(new BigInteger("100"),Currency.GBP);

//With Options

MerchantAuthOptions preauthOptions = new MerchantAuthOptions();

preauthOptions.setCustomerReference("CustomerReference");

api.preAuthorization(new BigInteger("100"),Currency.GBP, preauthOptions);

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation performed. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Pre-Auth Increase/Decrease

preAuthorizationIncrease

This operation allows the merchant to increase/decrease the amount of a previously performed pre-auth operation. For example, if a tab was opened at a restaurant and the consumer is adding new orders going above the initial pre-authorized amount, it is required to increase the amount of the initial pre-authorization before capturing it. If the merchant wants to release part of a pre-auth, an increase with negative amount should be passed to the function.

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of the pre-auth increase, in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

originalTransactionID Required String | Transaction ID of the original pre-auth operation |

preauthOptions Options | An object to store merchant authentication options for pre-auth operations. |

Code example

//Initiate a pre-auth increase for 1.00 in Great British Pounds

Options preauthOptions = new Options();

preauthOptions.setCustomerReference("CustomerReference");

api.preAuthorizationIncrease(new BigInteger("100"),Currency.GBP,"00000000-0000-0000-0000-000000000000", preauthOptions);

//Initiate a pre-auth decrease for 1.00 in Great British Pounds

Options preauthOptions = new Options();

preauthOptions.setCustomerReference("CustomerReference");

api.preAuthorizationIncrease(new BigInteger("-100"),Currency.GBP,"00000000-0000-0000-0000-000000000000", preauthOptions);

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation performed. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Pre-Auth Capture

preAuthorizationCapture

A pre-authorized transaction can be captured to actually debit the cardholder's account. Depending on the merchant category code, the capture needs to happen between 7 and 31 days after the original pre-authorization. If not captured the funds will be automatically released by the issuing bank.

Please note that a pre-authorization can only be captured ONCE, multiple partial captures are not allowed. If for some reason, the pre-authorization was captured for an incorrect amount, you can attempt to reverse the capture (does not work with all acquirers). If the capture reversal was declined, the cardholder needs to come back into the store with his card to get refunded or re-authorize the transaction. Alternatively, the cardholder can give his card details over the phone to the merchant and a MOTO pre-auth or MOTO refund can be issued.

Card schemes set specific rules around which businesses are able to use pre-auth transactions. Eligibility is determined based on the Merchant Category Code (MCC), together with the card scheme.

Card schemes have their own set of rules on authorisation expiry. Capturing a transaction after the scheme expiry time increases the risk of a failed capture, and may also increase the interchange and/or scheme fees charged for the transaction. Card schemes can also expire an authorisation before or after the official scheme expiry period has been reached. You can often capture a payment successfully after an authorisation has expired. Depending on the card scheme, there can be a fee for late capture, and an increase in interchange fee. The risk of cardholder chargebacks increase as well.

| Scheme | MCC |

|---|---|

| Mastercard | All MCCs except 5542 |

| Visa | All MCCs except 5542 |

| Discover | 3351-3441, 3501-3999, 4111, 4112, 4121, 4131, 4411, 4457, 5499, 5812, 5813, 7011, 7033, 7996, 7394, 7512, 7513, 7519, 7999 |

| American Express | All MCCs except 5542 |

VISA rules

| MCC | Segment | Authorization timeframe | Amount tolerance (captured amount above pre-authorized amount) |

|---|---|---|---|

| 3501-3999, 7011 | Lodging | 31 days | 15% |

| 3351-3500, 7512 | Car Rental | 31 days | 15% |

| 4411 | Steamship and Cruise Lines | 31 days | 15% |

| 7513 | Truck Rentals | 7 days | 15% |

| 7033 | Trailer Parks and Campgrounds | 7 days | 15% |

| 7519 | Motor Home and Recreational Vehicle Rentals | 7 days | 15% |

| 5552 | Electric Vehicle Charging | 7 days | 15% |

| 7523 | Parking and Garages | 7 days | 15% |

| 7394 | Equipment, Tool, Furniture and Appliance Rental | 7 days | none |

| 7999 | Recreation Services | 7 days | none |

| 7996 | Amusement Parks, Carnivals, Circuses, Fortune Tellers | 7 days | none |

| 5599 | Miscellaneous Automotive, Aircraft, and Farm Equipment Dealers | 7 days | none |

| 4457 | Boat Rentals and Leasing | 7 days | none |

| 5571 | Motorcycle Shops and Dealers | 7 days | none |

| 4111 | Local and Suburban Commuter, Passenger Transportation, including Ferries | 7 days | 25 USD (or equivalent amount in local currency) |

| 4112 | Passenger Railways | 7 days | 25 USD (or equivalent amount in local currency) |

| 4131 | Bus Lines | 7 days | 25 USD (or equivalent amount in local currency) |

| 5812 | Eating Places and Restaurants | Same day | 20% |

| 5813 | Drinking Places, Bars, Taverns, Cocktail Lounges, Nightclubs, Discotheques | Same day | 20% |

| 4121 | Taxicabs and Limousines (Card-Absent Environment only) | Same day | 20% |

MASTERCARD rules

| MCC | Authorization timeframe | Amount tolerance (captured amount above pre-authorized amount) |

|---|---|---|

| All MCCs | 30 days | 20% |

Maestro rules

| MCC | Segment | Authorization timeframe | Amount tolerance (captured amount above pre-authorized amount) |

|---|---|---|---|

| 5812 | Eating Places and Restaurants | 7 days | 20% |

| 5814 | Fast Food Restaurants | 7 days | 20% |

AMEX rules

| MCC | Authorization timeframe |

|---|---|

| All MCCs | 7 days |

| Note: Pre-Auth with AMEX is only available in the United States/Canada with the processor TSYS. |

Discover rules

| MCC | Authorization timeframe |

|---|---|

| Car Rental, Hotel/Lodging MCCs | 30 days |

| All MCCs except Car Rental and Hotel/Lodging | 10 days |

Diners rules

| MCC | Debit/credit | Authorization timeframe |

|---|---|---|

| Car Rental, Hotel/Lodging MCCs | All | 30 days |

| All MCCs except Car Rental and Hotel/Lodging | Credit | 30 days |

| All MCCs except Car Rental and Hotel/Lodging | Debit | 7 days |

JCB rules

| MCC | Authorization timeframe |

|---|---|

| Hotel and Car rental | Time of stay/rental |

| All MCCs except Hotel and Car rental | 1 year |

Parameters

| Parameter | Notes |

|---|---|

amount Required BigInteger | Amount of funds to pre-auth - in the minor unit of currency (f.ex. 1000 is 10.00 GBP) |

currency Required Currency | Currency of the charge |

originalTransactionID Required String | Transaction id of the original pre-auth transaction |

preauthOptions Options | An object to store merchant authentication options for pre-auth operations. |

Code example

//Initiate a pre-auth capture for 1.00 in Great British Pounds

Options preauthOptions = new Options();

preauthOptions.setCustomerReference("CustomerReference");

api.preAuthorizationCapture(new BigInteger("1000"),Currency.GBP,"00000000-0000-0000-0000-000000000000", preauthOptions);

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation performed. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

Pre-Auth/Capture Reversal

preAuthorizationReversal

A Pre-Auth reversal allows the user to reverse a previous pre-auth operation. This operation reverts (if possible) a specific pre-auth identified with a transaction id. A pre-authorized reversal transaction will release the whole pre-authorized amount, for example when renting a car, the pre-auth reversal allows the merchant to release the funds if the car was not damaged. For partial releases, please check the Pre-Auth Increase/Decrease operation.

A Pre-Auth reversal can be used to reverse a capture operation as well. A capture reversal transaction will release all the funds withheld. Reversing a capture operation can only be done before the funds are automatically settled at night, please note that not all acquirers support reversal of captured transactions. If a capture reversal is attempted after the funds have been moved, the operation will receive a decline.

When the capture is reverted it returns to the previous state (CAPTURED -> AUTHORISED).

Parameters

| Parameter | Notes |

|---|---|

originalTransactionID Required String | Transaction id of the original pre-auth or capture GUID transaction. |

preauthOptions Options | An object to store merchant authentication options for pre-auth operations. |

Code example

//Initiate a pre-auth reversal

api.preAuthorizationReversal("00000000-0000-0000-0000-000000000000");

Options preauthOptions = new Options();

preauthOptions.setCustomerReference("CustomerReference");

//Initiate a pre-auth reversal with options

api.preAuthorizationReversal("00000000-0000-0000-0000-000000000000", preauthOptions);

Events invoked

Invoked during a transaction, it fetches statuses coming from the terminal (ex : 'waiting for card' or 'waiting for PIN entry').

Invoked when the terminal finishes processing the transaction.

Returns

| Parameter | Notes |

|---|---|

| OperationStartResult | Object containing information about the financial operation performed. Most specifically the transactionReference which must be saved on your end in case you do not get back the transaction result object at the end of the transaction. The transactionReference will allow you to query the Handpoint Gateway directly to know the outcome of the transaction in case it is not delivered as planned by the terminal at the end of the transaction. |

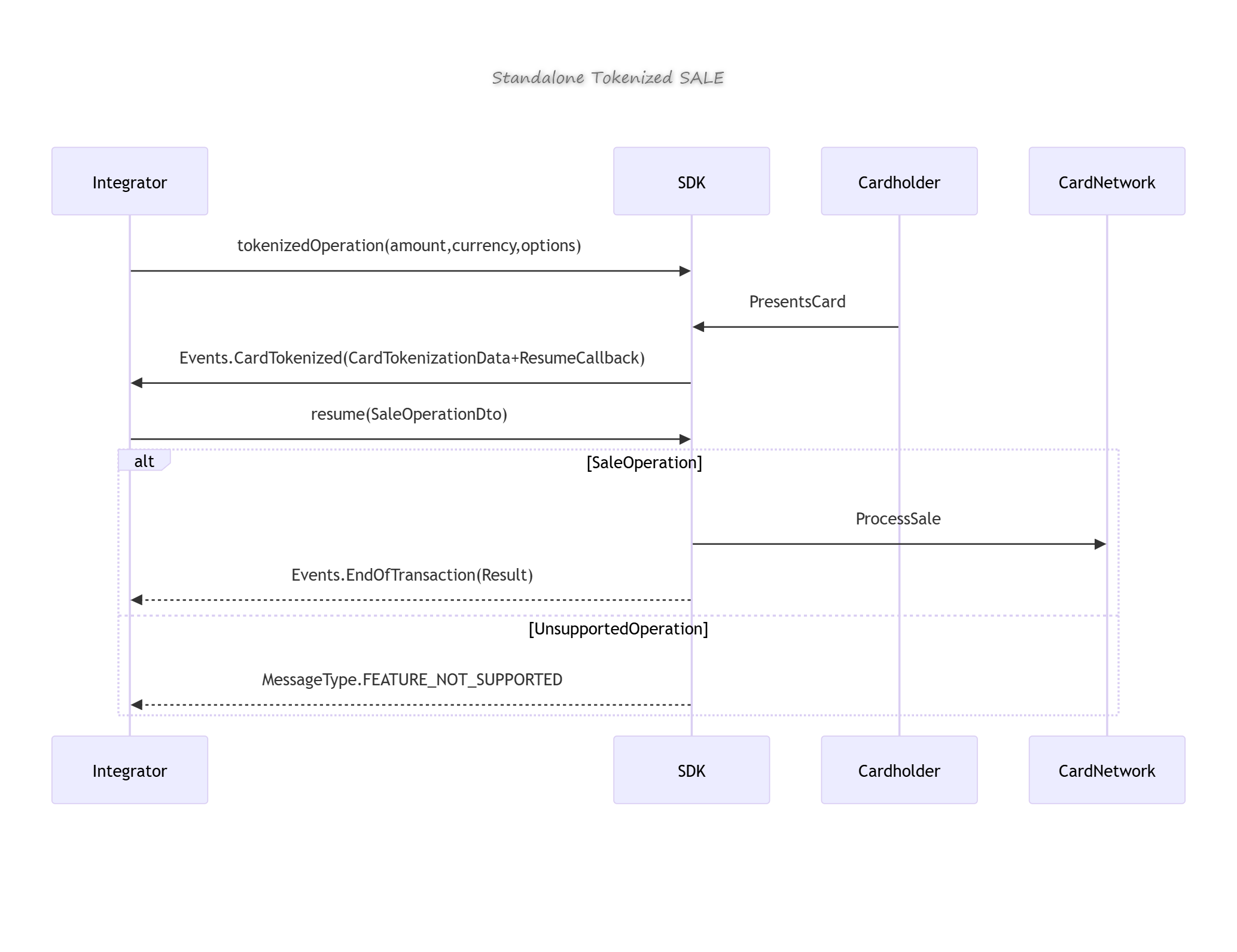

Standalone Tokenized Payments Operations (Tokenize and Modify)

standaloneTokenizedPaymentsOperations

Standalone Tokenized Sale

** Overview **

The tokenizedOperation functionality in the Handpoint Android SDK enables card tokenization followed by a sale transaction. It is executed through the Hapi Android interface.

This operation consists of two stages:

- Card Tokenization: The SDK tokenizes the card and triggers the

Events.CardTokenizedevent, providing the tokenized card details and control callbacks. - Sale Execution: The integrator must invoke the

resume()method from the callback object to proceed with the sale transaction. The outcome is returned through theEvents.EndOfTransactionevent.

** Method Signature **

/**

* Tokenized Operation on a specific device using regular parameters.

* This operation consists of two parts. The first part, performs a tokenization of the card,

* whose token is sent to the integrator through the Events.CardTokenized event.

* Once the integrator wishes to continue the operation,

* it must execute the resume method of the object sent through the event,

* with the data of the operation it wishes to perform.

* This operation will be executed and

* the result will be received through the Events.EndOfTransaction event.

* The operation supported is Sale.

*

* @param amount The transaction amount.

* @param currency The currency to be used.

* @param options An object containing configuration parameters for customer reference.

* @return True if the command was sent successfully to the device. False if sending failed.

*/

@JvmOverloads

fun tokenizedOperation(amount: BigInteger, currency: Currency, options: Options = Options()): OperationStartResult

** Events Flow **

*** 1. Events.CardTokenized ***

Triggered after the card is tokenized. Provides:

CardTokenizationData: Contains tokenized card information.ResumeCallback: Allows the integrator to resume, cancel, or finish the operation.

*** 2. Events.EndOfTransaction ***

Triggered after the sale transaction is completed, returning the transaction result.

** cardTokenized Event Components **

*** CardTokenizationData ***

| Field | Type | Description |

|---|---|---|

token | String | Tokenized card value. |

expiryDate | String | Card's expiry date. |

tenderType | TenderType | Transaction type: CREDIT, DEBIT, or NOT_SET. |

issuerCountryCode | CountryCode | Country code of the issuer (defaults to Unknown). |

cardBrand | String | Brand of the card (e.g., Visa, MasterCard). |

languagePref | String | Preferred language setting. |

tipAmount | BigInteger | Tip amount (defaults to BigInteger.ZERO). |

*** ResumeCallback ***

Interface responsible for managing the continuation or termination of the tokenization operation.

| Method | Description | Exceptions |

|---|---|---|

fun resume(operationDto: OperationDto) | Continues the operation with a specified OperationDto. Only Sale operations are allowed. | ResumedOperation, CancelledOperation, TimeoutOperation, IllegalStateException |

fun finishWithoutCardOperation() | Completes the operation without proceeding to a card transaction. | ResumedOperation, CancelledOperation, TimeoutOperation, IllegalStateException |

fun cancel() | Cancels the ongoing operation. | ResumedOperation, CancelledOperation, TimeoutOperation, IllegalStateException |

Note:

Calling any method multiple times, after timeout, or after cancellation triggers exceptions.

*** Example Handling of Events.CardTokenized (Kotlin) ***

override fun onCardTokenized(

cardTokenizationData: CardTokenizationData,

resumeCallback: ResumeCallback

) {

// Access tokenized card details

val token = cardTokenizationData.token

val cardBrand = cardTokenizationData.cardBrand

// Decide next action: proceed with sale

resumeCallback.resume(

OperationDto.Sale(

amount = BigInteger.valueOf(2000),

currency = Currency.getInstance("USD"),

options = SaleOptions(/* configuration options */)

)

)

}

** OperationDto **

A sealed class representing supported transaction types after tokenization.

| Subclass | Fields | Description |

|---|---|---|

Sale | amount: BigInteger, currency: Currency, options: SaleOptions | Initiates a sale transaction. |

Refund | amount: BigInteger, currency: Currency, originalTransactionID: String?, options: RefundOptions | Initiates a refund transaction. (Not allowed after tokenization) |

SaleReversal | amount: BigInteger, currency: Currency, originalTransactionID: String, options: SaleReversalOptions | Reverses a previous sale. (Not allowed after tokenization) |

RefundReversal | amount: BigInteger, currency: Currency, originalTransactionID: String, options: RefundReversalOptions | Reverses a previous refund. (Not allowed after tokenization) |

** Behavior and Restrictions **

-

Only

Saleoperations are allowed when invokingresume()after receiving thecardTokenizedevent.- Passing other operation types (

Refund,SaleReversal,RefundReversal) will result in a transaction result withMessageType.FEATURE_NOT_SUPPORTED.

- Passing other operation types (

-

Proper exception handling is required when using the

ResumeCallbackmethods.

** Exceptions **

| Exception | Description |

|---|---|

ResumedOperation | Thrown if the operation was already resumed. |

CancelledOperation | Thrown if the operation was previously cancelled. |

TimeoutOperation | Thrown if the operation timed out. |

IllegalStateException | Thrown for any invalid operation state. |

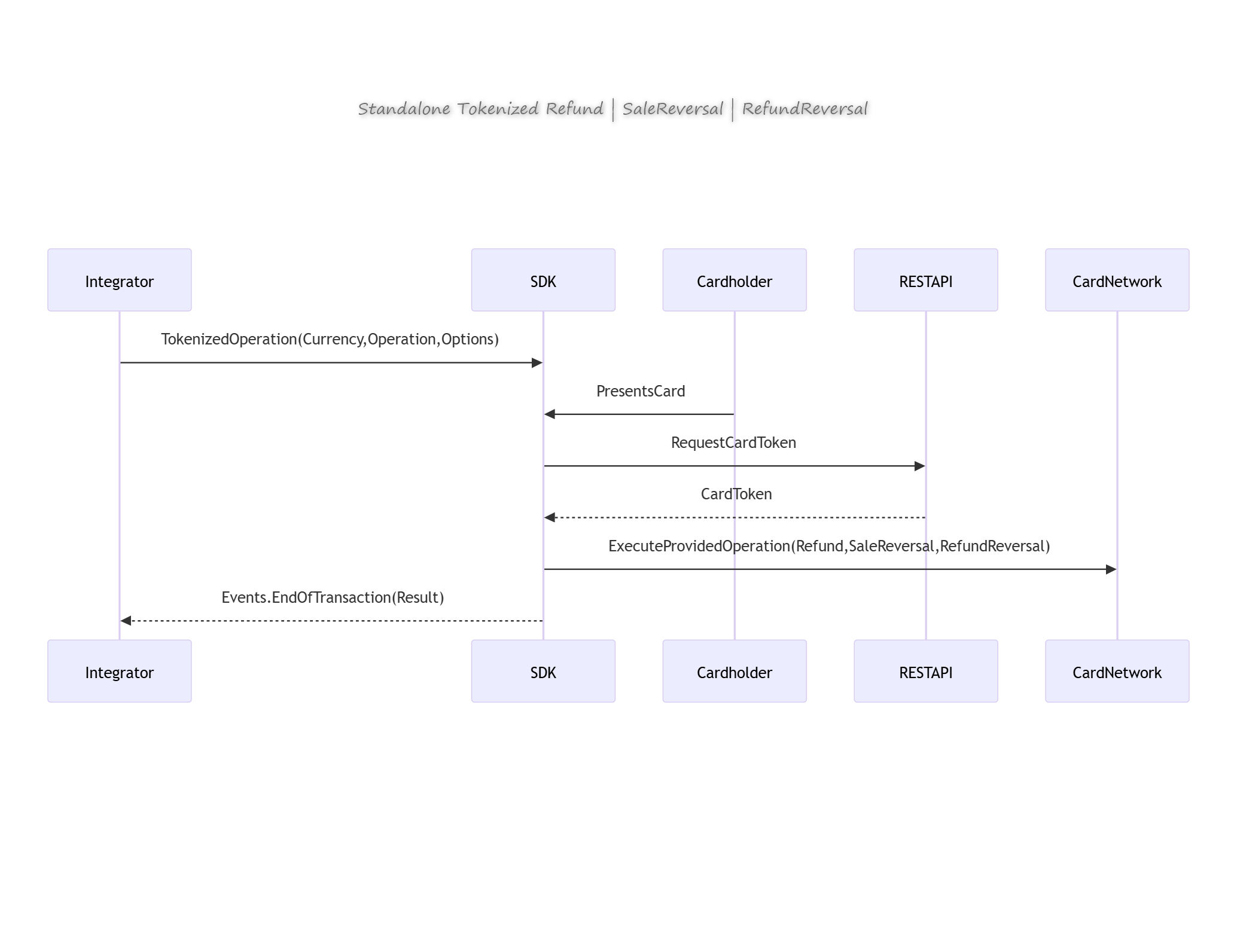

** Sequence Diagram **

** Summary **

The tokenizedOperation method securely tokenizes card data and passes control to the integrator via the Events.CardTokenized event, delivering:

CardTokenizationData: Contains the tokenized card details.ResumeCallback: Allows integrators to resume with a supportedSaleoperation, cancel, or finish without a transaction.

The result of the operation is returned through the Events.EndOfTransaction event.

Tip: Always validate and handle exceptions when interacting with

ResumeCallbackto ensure smooth operation flow.

Standalone Tokenized Refund, Reversal and RefundReversal

standaloneTokenizedRefund

** Overview **

The tokenizedOperation functionality in the Handpoint Android SDK allows the execution of a card tokenization followed immediately by a specified operation (such as SaleReversal, Refund, or RefundReversal).

In this version, the integrator provides the required operation as a parameter, and the SDK performs:

- Card Tokenization (with a REST API request to retrieve the card token).

- Execution of the operation passed by the integrator.

The result of both actions is delivered through the Events.EndOfTransaction event.

** Method Signature **

/**

* Tokenized Operation on a specific device using regular parameters.

* This operation consists of the consecutive execution of two operations:

* Tokenization of the card and the operation passed by parameter by

* the integrator. The result of both operations will be received through

* the Events.EndOfTransaction event.

* The operations supported are: SaleReversal, Refund, RefundReversal

*

* @param currency The currency to be used.

* @param operation The operation to be executed.

* @param options An object containing configuration parameters for customer reference.

* @return True if the command was sent successfully to the device. False if the sending was not successful.

*/

fun tokenizedOperation(

currency: Currency,

operation: OperationDto,

options: Options = Options()

): OperationStartResult

** Events Flow **

*** Events.EndOfTransaction ***

Triggered after both card tokenization and the specified operation are executed. The integrator receives the final transaction result in this event.

** Supported Operations **

This version of tokenizedOperation supports the following OperationDto types:

| OperationDto Subclass | Fields | Description |

|---|---|---|

Refund | amount: BigInteger, currency: Currency, originalTransactionID: String?, options: RefundOptions | Initiates a refund transaction. |

SaleReversal | amount: BigInteger, currency: Currency, originalTransactionID: String, options: SaleReversalOptions | Reverses a previous sale. |

RefundReversal | amount: BigInteger, currency: Currency, originalTransactionID: String, options: RefundReversalOptions | Reverses a previous refund. |

Note:

Saleoperation is not supported in this version oftokenizedOperation.

** Tokenization Process **

Internally, the SDK performs a REST API call to retrieve the card token. Once retrieved, it immediately proceeds to execute the operation provided by the integrator.

*** Example Usage (Kotlin) ***

val refundOperation = OperationDto.Refund(

amount = BigInteger.valueOf(1500),

currency = Currency.getInstance("EUR"),

originalTransactionID = "TX123456",

options = RefundOptions(/* options */)

)

val result = hapi.tokenizedOperation(

currency = Currency.getInstance("EUR"),

operation = refundOperation,

options = Options(/* config */)

)

** Behavior and Restrictions **

-

The SDK will automatically execute both:

- Tokenization (via REST API).

- The provided operation (

Refund,SaleReversal, orRefundReversal).

-

The integrator will receive the outcome via

Events.EndOfTransaction. -

Sale operations are not allowed in this mode.

** Exceptions **

The method itself returns false if the command fails to send to the device. Other exceptions related to transaction processing will be communicated via the Events.EndOfTransaction event.

** Sequence Diagram **

** Summary **

The tokenizedOperation method allows integrators to provide a specific operation upfront (Refund, SaleReversal, RefundReversal). The SDK:

- Retrieves the card token via REST API.

- Immediately executes the operation.

- Returns the result via

Events.EndOfTransaction.

Tip: Use this method when you want to perform tokenization and the operation in one streamlined flow, without intermediate decision points.

Cloud Tokenized Payments Operations

cloudTokenizedPaymentsOperations

** Overview **

In Cloud mode, integrators can control the Android SDK via one of our Cloud clients, which are our REST API, JavaScript SDK and Windows SDK.

There are two possible types of Cloud integrations:

- Integration with a callback URL

- Integration with Polling

Integration with a callback URL

If a callbackUrl and a token are included in the request, the terminal sends a POST with the transaction result to the specified URL. The token will be included in the HTTP header as AUTH-TOKEN and can be used on the callback URL side to identify or authenticate the call.

Example:

Request:

curl -X POST -H"ApiKeyCloud: XXXXXXX-KXDMZV1-HW8MXBG-XXXXXXX" -H"Content-Type: application/json" \

-d '{"operation": "sale", "terminal_type":"PAXA910S", "serial_number": "2840011110", "amount": "1034", "currency": "EUR", "tokenize": true, "callbackUrl": "https://results.example.com/callback", "token": "auth-token-1" }' \

https://cloud.handpoint.io/transactions

Response:

{"statusMessage":"Operation Accepted"}

Callback:

The following is an example of the transaction result sent to the specified callbackUrl:

{

"accountType": "",

"aid": "A0000000041010",

"arc": "0000",

"authorisationCode": "010119",

"balance": null,

"budgetNumber": "",

"cardEntryType": "ICC",

"cardHolderName": "",

"cardLanguagePreference": "",

"cardSchemeName": "VISA",

"cardToken": "535120cMXnuK6046",

"cardTypeId": "************6046",

"chipTransactionReport": "",

"currency": "EUR",

"customData": "...",

"customerReceipt": "https://receipts.handpoint.io/receipts/f6059a10-c1fe-11ef-9cf2-8b8a2cdbabca/customer.html",

"customerReference": "",

"deviceStatus": {

"applicationName": "Atom",

"applicationVersion": "20.4.9.2-RC.5",

"batteryCharging": "Full",

"batteryStatus": "100",

"batterymV": "8154",

"bluetoothName": "PAXA910S",

"externalPower": "USB",

"serialNumber": "2840011110",

"statusMessage": ""

},

"dueAmount": 0,

"errorMessage": "",

"expiryDateMMYY": "0129",

"finStatus": "AUTHORISED",

"iad": "0210A04003240000000000000000000000FF",

"issuerResponseCode": "00",

"maskedCardNumber": "************6046",

"merchantAddress": "Random Street, Some City",

"merchantName": "Random Merchant",

"merchantReceipt": "https://receipts.handpoint.io/receipts/f6059a10-c1fe-11ef-9cf2-8b8a2cdbabca/merchant.html",

"metadata": null,

"mid": "12S001",

"moneyRemittanceOptions": null,

"multiLanguageErrorMessages": {},

"multiLanguageStatusMessages": {

"en_CA": "Approved or completed successfully",

"fr_FR": "Transaction approuvée"

},

"originalEFTTransactionID": "",

"paymentScenario": "CHIPCONTACTLESS",

"requestedAmount": 524,

"rrn": "513815902180",

"signatureUrl": "",

"statusMessage": "Approved or completed successfully",

"tenderType": "CREDIT",

"tid": "123123",

"tipAmount": 0,

"totalAmount": 524,

"transactionID": "16059a10-c1fe-11ef-9cf2-8b8a2cdbabca",

"transactionOrigin": "CLOUD",

"transactionReference": "b45ff306-78f2-4d3b-970c-e47c8d9b9f83",

"tsi": "0000",

"tvr": "0000008001",

"type": "SALE",

"unMaskedPan": "",

"verificationMethod": "NOT_REQUIRED",

"efttimestamp": 1735048275000,

"efttransactionID": "16059a10-c1fe-11ef-9cf2-8b8a2cdbabca",

"tipPercentage": 0.0,

"recoveredTransaction": false

}

Integration using Polling

If the request does not include a callbackUrl and a token, then polling can be used to retrieve the transaction result from Handpoint's transaction-result endpoint.

Example:

Request:

curl -X POST -H"ApiKeyCloud: XXXXXXX-KXDMZV1-HW8MXBG-XXXXXXX" -H"Content-Type: application/json" \

-d '{"operation": "sale", "terminal_type":"PAXA910S", "serial_number": "2840011110", "amount": "1034", "currency": "EUR", "tokenize": true }' \

https://cloud.handpoint.io/transactions

Response:

Using the transactionResultId, integrators can poll the transaction-result endpoint to retrieve the result:

{

"statusMessage": "Operation Accepted",

"transactionResultId": "1840011114-1735048331833"

}

Polling request:

curl -i -X GET -H"ApiKeyCloud: XXXXXXX-XXXXXXX-XXXXXXX-XXXXXXX" -H"Content-Type: application/json" \

https://cloud.handpoint.io/transaction-result/1840011114-1735048331833

Possible responses from polling:

- 204: Transaction still in process.

- 200: Transaction result is available.

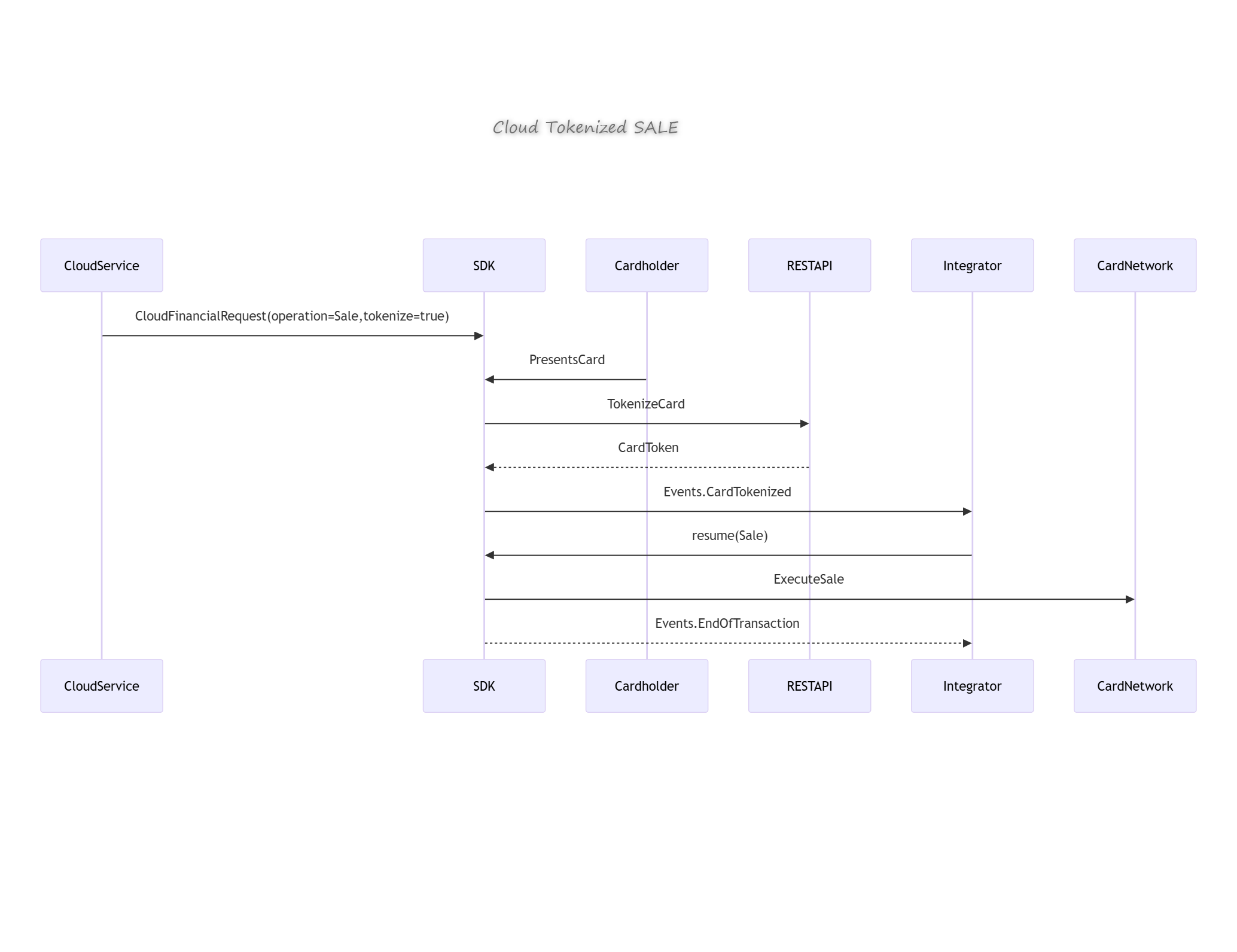

Cloud Tokenized Sale

Overview

The Cloud Tokenized Operation enables remote-triggered financial operations, where a cloud-based system initiates a request to tokenize a card and perform a Sale transaction using the Android SDK.

This operation is initiated by sending a CloudFinancialRequest object. The SDK handles the following workflow:

- Parses and validates the

CloudFinancialRequest. - Tokenizes the card (if

tokenizeistrueandoperationisSale). - Triggers the

Events.CardTokenizedevent with token and callback. - Proceeds with the Sale operation upon

resume()call. - Emits the final result via

Events.EndOfTransaction.

CloudFinancialRequest

Description

A data object that represents the request payload for initiating cloud-based financial operations including tokenized sales.

Key Fields

| Field | Type | Description |

|---|---|---|

operation | Operations | Must be set to Operations.Sale for this flow. |

tokenize | Boolean | Must be set to true to trigger card tokenization. |

amount | String? | Transaction amount as string. |

currency | String? | Currency code. |

callbackUrl | String? | If present, indicates REST API request. |

originalTransactionId | String | Identifier of original transaction (if any). |

uuid | String | Event UUID, auto-formatted as 6-digit string. |

transactionReference | String | Reference for idempotency; auto-generated if blank. |

receipt | String? | Raw or URL-based receipt data. |

metadata | Metadata? | Optional metadata for the operation. |

merchantAuth | MerchantAuth? | Merchant authentication object. |

duplicateCheck | Boolean | Enables duplicate request validation. |

duplicateCheckEndpoint | String | Optional custom endpoint for duplicate checks. |

Note: Other fields may be present but are not required for the tokenized Sale flow.

Internal Behavior

- The SDK uses

getParsedAmount()andgetParsedCurrency()to convert string values into typedBigIntegerandCurrency. - If

callbackUrlis present, the request is treated as a REST API request. - If

tokenizeistrueandoperation == Sale, the card is tokenized, and theEvents.CardTokenizedevent is emitted. - After receiving the

resume()call, the SDK performs the Sale operation.

Events Flow

Events.CardTokenized

Emitted after card tokenization. Provides:

CardTokenizationData: Includes card token and card info.ResumeCallback: To resume with theSaleoperation.

Events.EndOfTransaction

Emitted after the sale is completed.

Behavior and Restrictions

- The only supported operation for this flow is Sale.

- Must set:

operation = Operations.Saletokenize = true

- Invoking

resume()with any operation other thanSalewill result inMessageType.FEATURE_NOT_SUPPORTED.

Example CloudFinancialRequest JSON

{

"operation": "Sale",

"tokenize": true,

"amount": "1000",

"currency": "EUR",

"transactionReference": "a1b2c3d4",

"callbackUrl": "https://merchant.com/callback"

}

Example Kotlin Flow

override fun onCardTokenized(

cardTokenizationData: CardTokenizationData,

resumeCallback: ResumeCallback

) {

val sale = OperationDto.Sale(

amount = cardTokenizationData.tipAmount,

currency = Currency.getInstance("EUR"),

options = SaleOptions(/* additional config */)

)

resumeCallback.resume(sale)

}

Sequence Diagram

Summary

The Cloud Tokenized Operation enables external services to initiate tokenized Sale transactions through a structured CloudFinancialRequest. The SDK handles card tokenization and executes the Sale transaction if the correct flags are set.

Tip: This is ideal for headless or server-triggered flows that require secure card tokenization and transaction execution in a single interaction.

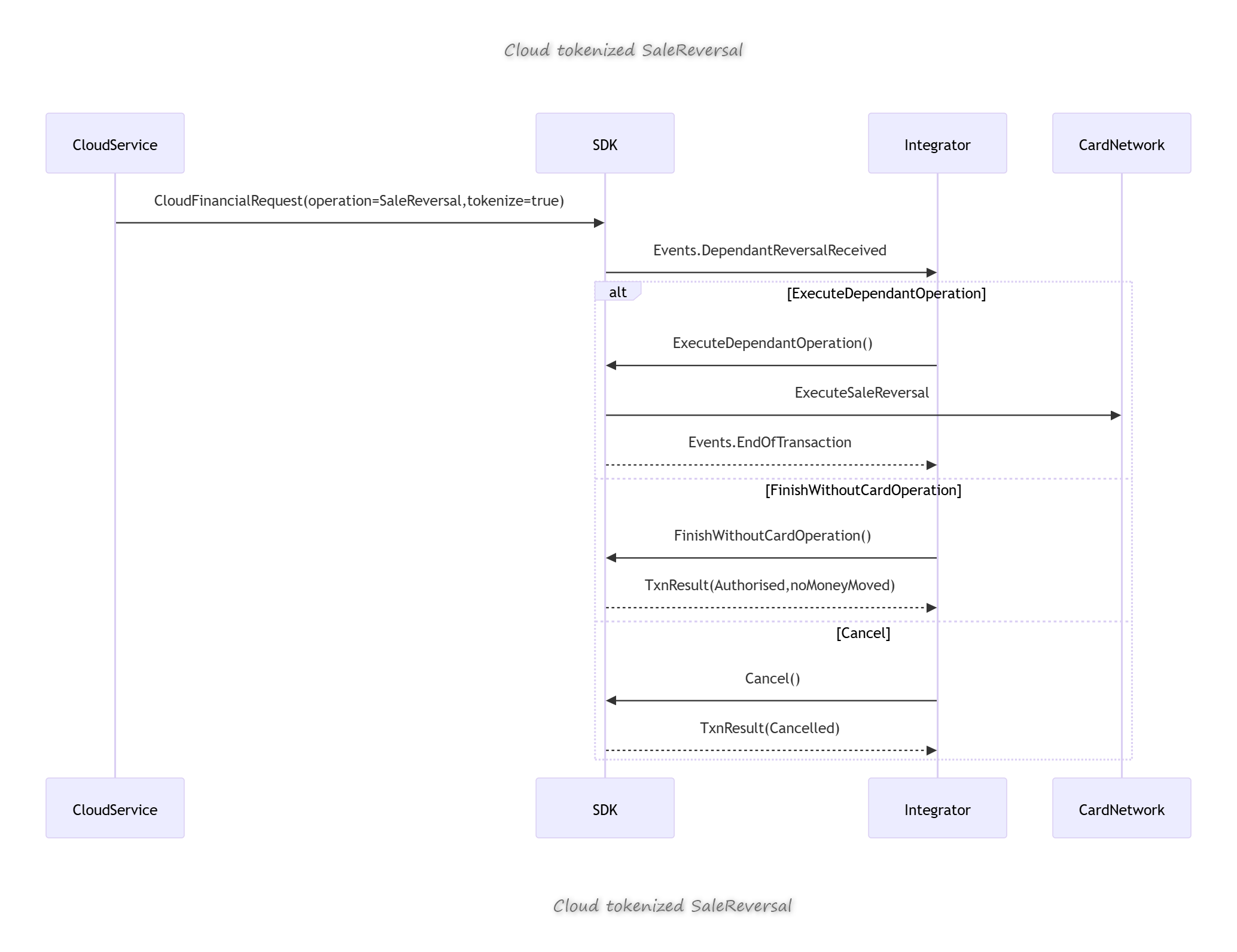

Cloud Tokenized Sale Reversal

Overview

The Sale Reversal Tokenized Operation is a cloud-initiated process that tokenizes a card and performs a Sale Reversal transaction. This operation is triggered via a CloudFinancialRequest object and follows the same interaction pattern as other dependant tokenized operations.

It is identified by:

operation = Operations.SaleReversaltokenize = true

Upon receiving this request, the SDK emits the Events.DependantReversalReceived event. The integrator is then responsible for controlling the transaction flow using the ResumeDependantOperationExecutor interface.

CloudFinancialRequest Configuration

Required Fields

| Field | Value | Description |

|---|---|---|

operation | Operations.SaleReversal | Identifies a Sale Reversal request. |

tokenize | true | Triggers tokenization before the operation. |

Other fields such as originalTransactionId, currency, amount, and transactionReference must also be set as needed.

Event: Events.DependantReversalReceived

Emitted when the SDK receives a cloud request for a Sale Reversal with tokenization enabled. The integrator handles this event via the DependantOperationEvent interface:

interface DependantOperationEvent {

fun dependantRefundReceived(

amount: BigInteger,

currency: Currency,

originalTransactionId: String,

resumeDependantOperation: ResumeDependantOperation

)

fun dependantReversalReceived(

originalTransactionId: String,

resumeDependantOperation: ResumeDependantOperation

)

}

Interface: ResumeDependantOperationExecutor

interface ResumeDependantOperationExecutor {

fun executeDependantOperation(amount: BigInteger, currency: Currency, originalTransactionId: String)

fun finishWithoutCardOperation()

fun cancel()

}

Implementation: ResumeDependantSaleReversalExecutorImpl

class ResumeDependantSaleReversalExecutorImpl(

private val currency: Currency,

private val originalTransactionId: String,

private val options: InternalSaleReversalOptions,

private val delegate: Hapi

): ResumeDependantOperationExecutor {

override fun executeDependantOperation(amount: BigInteger, currency: Currency, originalTransactionId: String) {

val refundOperationDto = OperationDto.SaleReversal(

amount,

currency,

originalTransactionId,

options

)

val result = delegate.tokenizedOperation(currency, refundOperationDto, options).operationStarted

if (!result) {

val transactionResult = InstancesManager.transactionData.generateTransactionResultWithoutResponse()

transactionResult.finStatus = FinancialStatus.FAILED

transactionResult.transactionOrigin = TransactionOrigin.CLOUD

sendTransactionResult(transactionResult)

}

}

override fun finishWithoutCardOperation() {

val transactionResult = InstancesManager.transactionData.generateTransactionResultWithoutResponse()

transactionResult.finStatus = FinancialStatus.AUTHORISED

transactionResult.type = TransactionType.VOID_SALE

transactionResult.currency = currency

transactionResult.totalAmount = BigInteger.ZERO

transactionResult.transactionOrigin = TransactionOrigin.CLOUD

transactionResult.transactionID = UUID.randomUUID().toString()

transactionResult.eFTTransactionID = transactionResult.transactionID

transactionResult.originalEFTTransactionID = originalTransactionId

InstancesManager.cardReader.isCardPresent = true

sendTransactionResult(transactionResult)

}

override fun cancel() {

val transactionResult = InstancesManager.transactionData.generateTransactionResultWithoutResponse()

transactionResult.finStatus = FinancialStatus.CANCELLED

transactionResult.type = TransactionType.VOID_SALE

transactionResult.currency = Currency.Unknown

transactionResult.totalAmount = BigInteger.ZERO

transactionResult.transactionOrigin = TransactionOrigin.CLOUD

transactionResult.originalEFTTransactionID = originalTransactionId

sendTransactionResult(transactionResult)

}

internal fun sendTransactionResult(transactionResult: TransactionResult) {

TransactionResultHandler.transactionFinished(transactionResult)

}

}

Behavior and Flow

| Method | Description |

|---|---|

executeDependantOperation(...) | Executes the SaleReversal operation after tokenization. |

finishWithoutCardOperation() | Returns an AUTHORISED transaction result without financial movement. |

cancel() | Sends a CANCELLED transaction result indicating cancellation. |

Sequence Diagram

Summary

The Sale Reversal Tokenized Operation is a secure, cloud-triggered flow for performing a Sale Reversal using a tokenized card. The operation is handled through the DependantReversalReceived event and executed with a ResumeDependantOperationExecutor implementation.

Tip: Use

finishWithoutCardOperation()when the sale reversal is already completed outside the SDK but you want to report it as authorised for consistency.

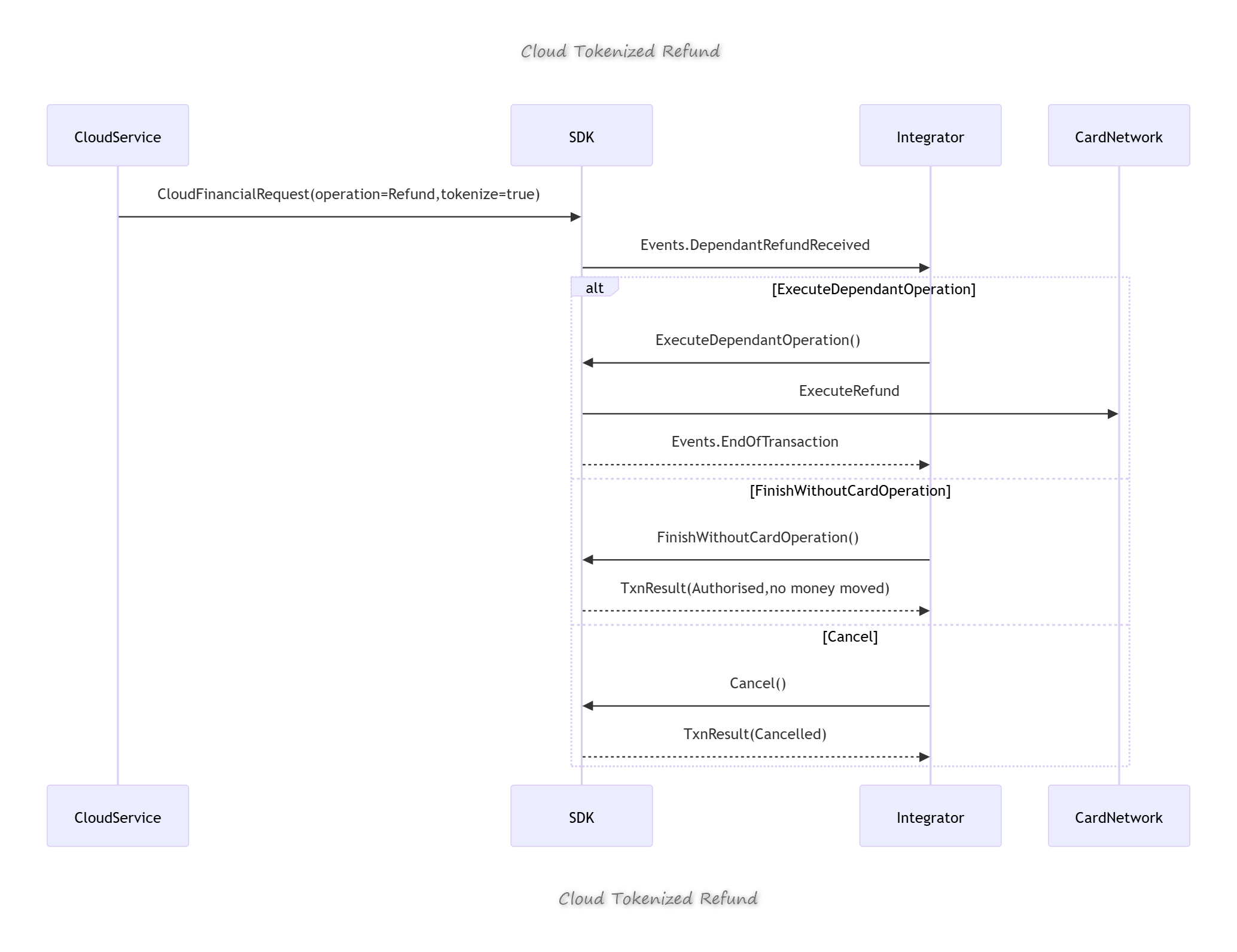

Cloud Tokenized Refund

Overview

The Refund Tokenized Operation is a cloud-based flow that allows merchants to initiate a tokenized refund from a remote system. It uses the same CloudFinancialRequest object as other cloud operations.

This operation is identified by:

operation = Operations.Refundtokenize = true

Upon receiving the request, the SDK emits the Events.DependantRefundReceived event. The integrator must handle this event by using the ResumeDependantOperationExecutor interface to define the next step.

CloudFinancialRequest Configuration

Required Fields

| Field | Value | Description |

|---|---|---|

operation | Operations.Refund | Indicates the refund operation. |

tokenize | true | Enables card tokenization. |

Other standard fields such as amount, currency, originalTransactionId, and transactionReference should be populated according to the use case.

Event: Events.DependantRefundReceived

Triggered when a tokenized refund request is received from the cloud. The integrator must respond using a ResumeDependantOperationExecutor implementation.

Interface: ResumeDependantOperationExecutor

Defines the actions the integrator must take after receiving the refund request.

interface ResumeDependantOperationExecutor {

fun executeDependantOperation(

amount: BigInteger,

currency: Currency,

originalTransactionId: String

)

fun finishWithoutCardOperation()

fun cancel()

}

Implementation: ResumeDependantRefundExecutorImpl

This implementation manages the refund operation execution and fallback flows.

class ResumeDependantRefundExecutorImpl(

private val currency: Currency,

private val options: InternalRefundOptions,

private val originalTransactionId: String,

private val delegate: Hapi

) : ResumeDependantOperationExecutor {

override fun executeDependantOperation(amount: BigInteger, currency: Currency, originalTransactionId: String) {

val refundOperationDto = OperationDto.Refund(

amount,

currency,

originalTransactionId.ifBlank { null },

options

)

val result = delegate.tokenizedOperation(currency, refundOperationDto, options).operationStarted

if (!result) {

val transactionResult = InstancesManager.transactionData.generateTransactionResultWithoutResponse()

transactionResult.finStatus = FinancialStatus.FAILED

sendTransactionResult(transactionResult)

}

}

override fun finishWithoutCardOperation() {

val transactionResult = InstancesManager.transactionData.generateTransactionResultWithoutResponse()

transactionResult.originalEFTTransactionID = originalTransactionId

transactionResult.finStatus = FinancialStatus.AUTHORISED

transactionResult.type = TransactionType.REFUND

transactionResult.currency = currency

transactionResult.totalAmount = BigInteger.ZERO

transactionResult.transactionOrigin = TransactionOrigin.CLOUD

transactionResult.transactionID = UUID.randomUUID().toString()

transactionResult.eFTTransactionID = transactionResult.transactionID

InstancesManager.cardReader.isCardPresent = true

sendTransactionResult(transactionResult)

}

override fun cancel() {

val transactionResult = InstancesManager.transactionData.generateTransactionResultWithoutResponse()

transactionResult.finStatus = FinancialStatus.CANCELLED

transactionResult.type = TransactionType.REFUND

transactionResult.currency = currency

transactionResult.totalAmount = BigInteger.ZERO

transactionResult.transactionOrigin = TransactionOrigin.CLOUD

transactionResult.originalEFTTransactionID = originalTransactionId

sendTransactionResult(transactionResult)

}

internal fun sendTransactionResult(transactionResult: TransactionResult) {

TransactionResultHandler.transactionFinished(transactionResult)

}

}

Behavior and Flow

| Method | Description |

|---|---|

executeDependantOperation(...) | Triggers the refund transaction using the provided amount, currency, and original transaction ID. |

finishWithoutCardOperation() | Sends a transaction result with AUTHORISED status but without processing a refund — used when the refund was completed outside the SDK. |

cancel() | Sends a transaction result with CANCELLED status — used when the integrator cancels the operation. |

Sequence Diagram

Summary

The Refund Tokenized Operation is a controlled cloud-based refund workflow that tokenizes the card and delegates control to the integrator for determining the refund outcome.

- Triggered via

CloudFinancialRequestwithoperation = Refundandtokenize = true. - Uses the

ResumeDependantOperationExecutorinterface to define the refund behavior. - Provides flexibility to execute, authorize without refund, or cancel the transaction.

Tip: Use

finishWithoutCardOperation()when refund logic is handled outside the SDK and you only need to notify the POS system.

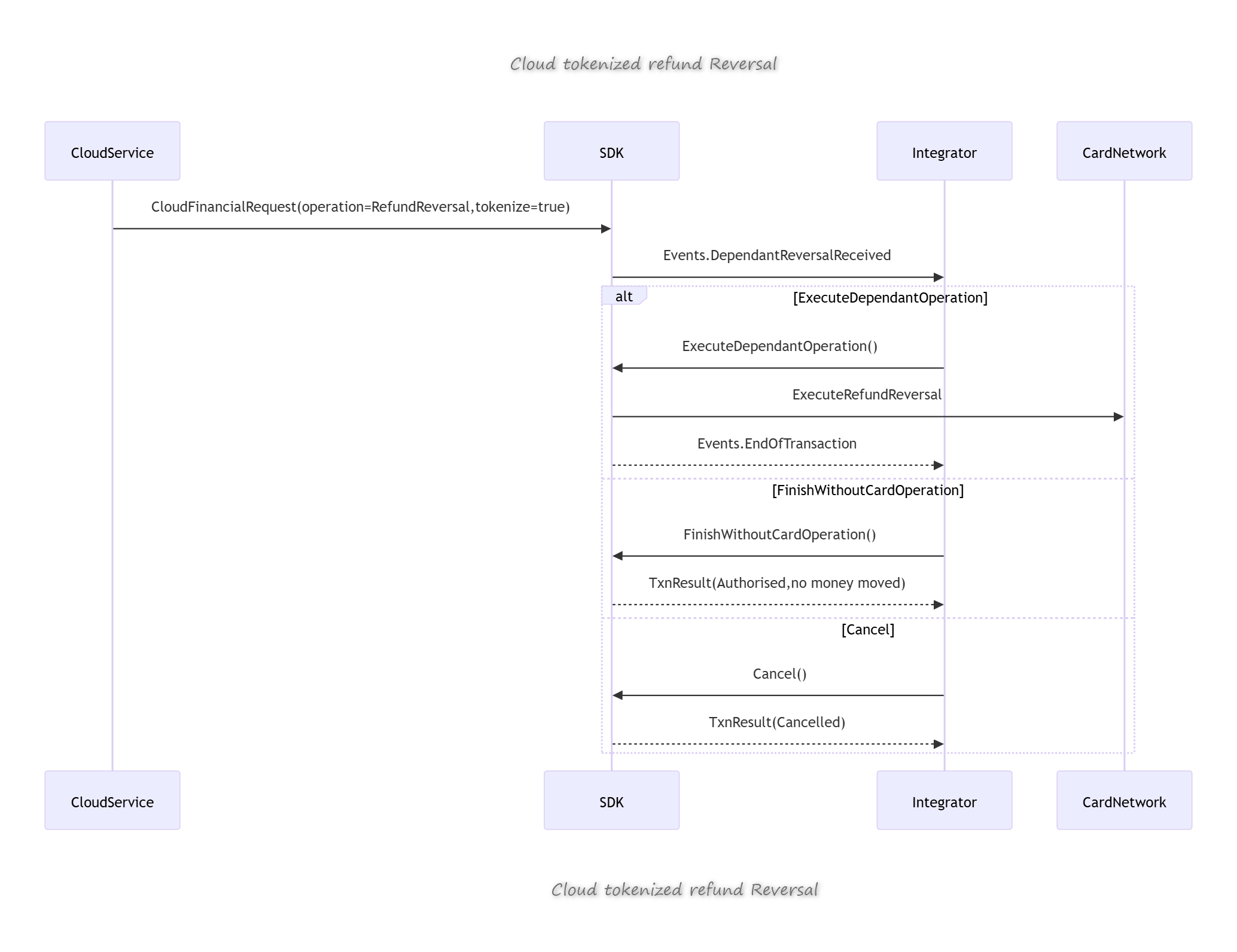

Cloud Tokenized Refund Reversal

Overview

The Refund Reversal Tokenized Operation is a cloud-triggered operation that securely tokenizes a card and performs a Refund Reversal. This operation is initiated via a CloudFinancialRequest object with:

operation = Operations.RefundReversaltokenize = true

After receiving the request, the SDK emits the Events.DependantReversalReceived event. The integrator must respond by using the ResumeDependantOperationExecutor interface to control how the operation proceeds.

CloudFinancialRequest Configuration

Required Fields

| Field | Value | Description |

|---|---|---|

operation | Operations.RefundReversal | Indicates the refund reversal operation. |

tokenize | true | Enables card tokenization. |

Other standard fields such as amount, currency, originalTransactionId, and transactionReference should also be included.

Event: Events.DependantReversalReceived

This event is emitted after receiving a valid cloud request for a refund reversal. The integrator must implement ResumeDependantOperationExecutor to define the next action.

Interface: ResumeDependantOperationExecutor

interface ResumeDependantOperationExecutor {

fun executeDependantOperation(

amount: BigInteger,

currency: Currency,

originalTransactionId: String

)

fun finishWithoutCardOperation()

fun cancel()

}

Implementation: ResumeDependantRefundReversalExecutorImpl

class ResumeDependantRefundReversalExecutorImpl(

private val currency: Currency,

private val originalTransactionId: String,

private val options: InternalRefundReversalOptions,

private val delegate: Hapi

): ResumeDependantOperationExecutor {

override fun executeDependantOperation(amount: BigInteger, currency: Currency, originalTransactionId: String) {

val refundOperationDto = OperationDto.RefundReversal(

amount,

currency,

originalTransactionId,

options

)

val result = delegate.tokenizedOperation(currency, refundOperationDto, options).operationStarted

if (!result) {

val transactionResult = InstancesManager.transactionData.generateTransactionResultWithoutResponse()

transactionResult.finStatus = FinancialStatus.FAILED

sendTransactionResult(transactionResult)

}

}

override fun finishWithoutCardOperation() {

val transactionResult = InstancesManager.transactionData.generateTransactionResultWithoutResponse()

transactionResult.finStatus = FinancialStatus.AUTHORISED

transactionResult.type = TransactionType.VOID_REFUND

transactionResult.currency = currency

transactionResult.totalAmount = BigInteger.ZERO

transactionResult.transactionOrigin = TransactionOrigin.CLOUD

transactionResult.transactionID = UUID.randomUUID().toString()

transactionResult.eFTTransactionID = transactionResult.transactionID

transactionResult.originalEFTTransactionID = originalTransactionId

InstancesManager.cardReader.isCardPresent = true

sendTransactionResult(transactionResult)

}

override fun cancel() {

val transactionResult = InstancesManager.transactionData.generateTransactionResultWithoutResponse()

transactionResult.finStatus = FinancialStatus.CANCELLED

transactionResult.type = TransactionType.VOID_REFUND

transactionResult.currency = Currency.Unknown

transactionResult.totalAmount = BigInteger.ZERO

transactionResult.transactionOrigin = TransactionOrigin.CLOUD

transactionResult.originalEFTTransactionID = originalTransactionId

sendTransactionResult(transactionResult)

}

internal fun sendTransactionResult(transactionResult: TransactionResult) {

TransactionResultHandler.transactionFinished(transactionResult)

}

}

Behavior and Flow

| Method | Description |

|---|---|

executeDependantOperation(...) | Launches the RefundReversal operation after tokenization. |

finishWithoutCardOperation() | Sends an AUTHORISED transaction result without moving funds — used when reversal is handled externally. |

cancel() | Sends a CANCELLED result indicating the integrator aborted the operation. |

Sequence Diagram

Summary

The Refund Reversal Tokenized Operation is a cloud-driven flow designed to securely tokenize a card and optionally reverse a refund. It follows the same interaction pattern as other dependant cloud operations, with three possible paths controlled by the integrator:

- Execute the refund reversal.

- Acknowledge the transaction without refund movement.

- Cancel the operation entirely.

Tip: Use this operation in cloud or headless setups where refunds need to be securely reversed with authorization logging.